Introduction

Jim Cramer, the dynamic host of Mad Money, once again delivered a detailed roadmap for investors, highlighting key sectors, earnings reports, and market trends to watch in the coming week. With his unique blend of analysis and actionable insights, Cramer shed light on how companies, economies, and investors can navigate market volatility, technological advancements, and shifting economic pressures.

This article distills the critical points from the program, providing a concise overview of the key discussions, actionable takeaways, and the potential implications for businesses, regions, and individuals.

Key Insights from Jim Cramer’s Game Plan

1. Market Volatility and Economic Indicators

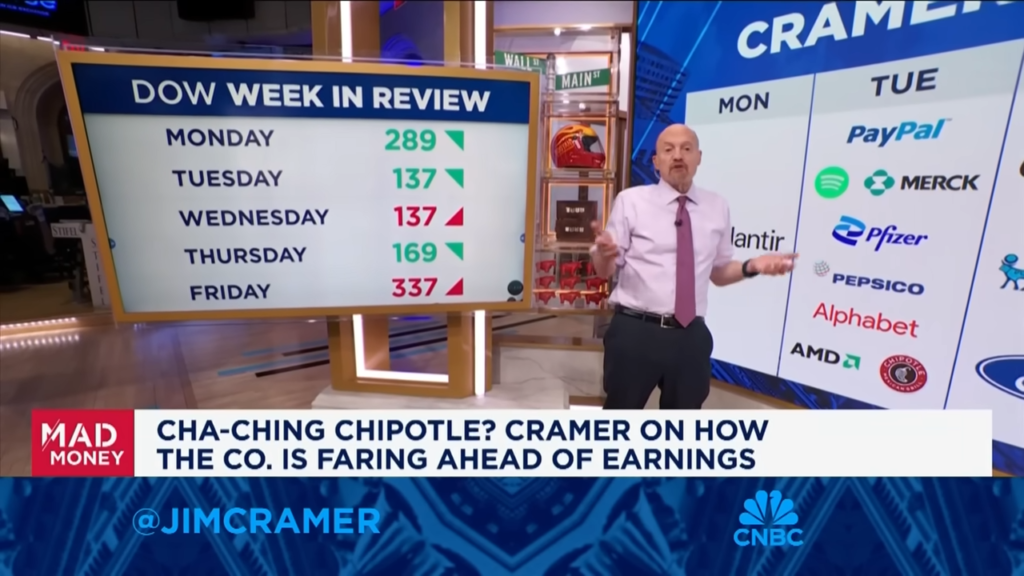

- Cramer flagged the ongoing tug-of-war between inflation fears and the Federal Reserve’s stance on interest rates. The upcoming release of the non-farm payroll report was underscored as a critical indicator of economic momentum.

- He expressed concerns over market reactions to macroeconomic data, advising investors to tread cautiously amid potential profit-taking in high-performing sectors.

2. Earnings Highlights to Watch

- Technology & Payments: Companies like PayPal and Alphabet (Google) were spotlighted. PayPal’s potential resurgence under new leadership and Alphabet’s focus on Google Cloud growth were seen as pivotal.

- Healthcare & Pharmaceuticals: Merck, Pfizer, and other pharmaceutical giants were under the microscope for their innovation pipelines, especially in cancer treatments and immunology. Cramer emphasized that breakthrough drugs could unlock significant value for these companies.

- Consumer and Retail: Chipotle and Spotify stood out as examples of resilient subscription and growth-based models. He pointed out that these companies, with their loyal customer bases, can weather economic uncertainties better than most.

3. Sectoral Observations

- Energy Transition: The growing importance of copper in electrification and renewable energy was acknowledged, but Cramer warned of overspeculation in mining stocks.

- Defense and Procurement: He raised concerns about inefficiencies in military procurement processes, suggesting opportunities for systemic reforms to reduce costs and improve resource allocation.

4. Potential Market Movers

- Earnings reports from Walt Disney, Ford, and Amazon could provide critical insights into consumer sentiment and spending patterns.

- The healthcare sector’s focus on innovation and its potential to offset inflationary pressures was another critical area to monitor.

Future Implications and Recommendations

For Businesses:

- Embrace Leadership Overhauls: Companies like PayPal, with new leadership, are repositioning for growth. Other businesses should similarly prioritize innovative strategies to capture market share.

- Focus on Scalability: Subscription-based models (Spotify, Chipotle) demonstrate the importance of customer retention and scalable revenue streams in uncertain markets.

For Regions and Economies:

- Sustainability in Resource Allocation: Reducing inefficiencies in industries like defense procurement can have significant fiscal benefits for governments.

- Energy Transition Opportunities: Policymakers and businesses must align on sustainable practices to capitalize on the growing demand for clean energy and critical resources like copper.

For Individuals:

- Investment Strategy: Investors should balance their portfolios, focusing on high-growth sectors while being cautious about overvalued stocks.

- Consumer Behavior: Consumers may need to adapt their spending habits as inflationary pressures and interest rate adjustments continue to shape the broader economy.

Conclusion

Jim Cramer’s market game plan offers a comprehensive guide for navigating the complexities of the coming week. With earnings season in full swing, investors and businesses must stay informed and agile. The interplay between macroeconomic forces, technological advancements, and consumer sentiment will define the market’s trajectory.

Follow-Up Questions:

- How will leadership changes at companies like PayPal influence the broader fintech sector?

- What strategies can governments and industries adopt to enhance resource efficiency?

- Will subscription-based models continue to outperform in the face of economic uncertainties?

Disclaimer

This article summarizes insights shared by Jim Cramer on his show Mad Money. It is intended for informational purposes only and should not be considered financial advice. Please consult a financial professional before making investment decisions.

Emily Shah is a financial writer and stock trader focused on ESG and technology stocks. Her insights regularly appear in leading investment blogs.