Introduction: A Pivotal Shift in Monetary Policy

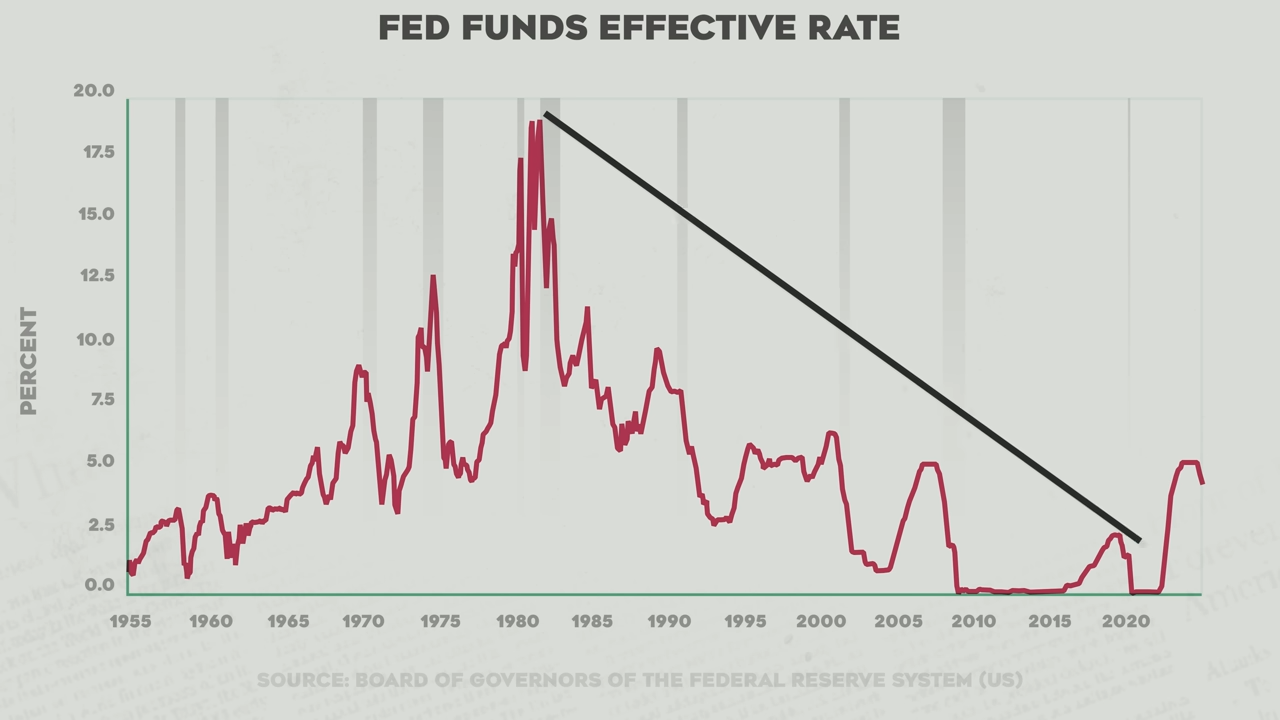

The Federal Reserve’s decision to pause interest rate cuts marks a critical moment in the ongoing battle against inflation and economic volatility. Initially, the Fed signaled that inflation was under control, prompting rate cuts in late 2024. However, recent data suggests that inflation remains persistent, forcing policymakers to halt further reductions.

This development has major implications for markets, businesses, and consumers, as the U.S. faces a scenario eerily like the stagflation of the 1970s. With the government running $2 trillion annual deficits, long-term interest rates continue to rise, indicating fiscal dominance, where government borrowing dictates economic conditions more than central bank policies.

This article breaks down what was discussed, the potential risks, and what the future holds for the U.S. economy, global markets, and investors.

Key Discussions and Economic Implications

The Federal Reserve’s Inflation Miscalculation

Since 2022, the Fed has raised rates to curb inflation, but after pausing in late 2023, it believed it had done enough to stabilize prices. The latest statement, however, removes language suggesting inflation is improving, signaling that price pressures remain a concern.

What This Means:

- Inflation remains elevated → Despite rate hikes, government spending and supply-side pressures are keeping prices high.

- The Fed’s 2% inflation target is slipping away → Policymakers acknowledge progress has stalled, raising fears of prolonged price instability.

- Potential policy reversal → If inflation accelerates again, the Fed may be forced to raise rates once more, risking a deeper economic slowdown.

This cycle is strikingly similar to the 1970s, when premature rate cuts led to multiple inflationary spikes, forcing central banks into aggressive tightening later.

The U.S. Government’s Unsustainable Fiscal Path

While monetary policy plays a crucial role in controlling inflation, the real driver today is fiscal policy—how much the government spends and borrows.

- Government revenue in 2024: $4.9 trillion in tax collections

- Government spending: Over $6.9 trillion, creating a $2 trillion deficit

- Debt servicing costs: Rising long-term rates mean the cost of borrowing is increasing, making it harder to sustain federal debt.

Why This Matters:

- Liquidity Drain: The government borrows heavily, removing cash from financial markets, leading to tighter credit conditions.

- Crowding Out Effect: Higher Treasury yields mean investors prefer government bonds over equities, weakening stock market growth.

- Risk of a Funding Crisis: If the U.S. government cannot control spending, confidence in Treasury markets may weaken, threatening the dollar’s stability.

The Banking System and Liquidity Risks

Another concern raised is the risk of a liquidity squeeze. While the Fed is continuing quantitative tightening (QT) at $25 billion per month, it may have to reverse course into quantitative easing (QE) sooner than expected.

Why Liquidity Matters:

- Less liquidity = higher borrowing costs for businesses and individuals.

- A repeat of 2019’s repo crisis? If liquidity becomes too scarce, financial markets could face severe dislocations.

- Potential Fed U-turn? If the financial system weakens, the Fed expects to halt QT and resume QE, injecting liquidity back into the system.

The last time such conditions arose, it triggered the 2008 financial crisis, raising concerns that markets may not be prepared for another credit crunch.

The Long-Term Outlook: The Risk of Fiscal Dominance

The conversation highlighted a growing reality: Monetary policy is increasingly powerless because the real driver of economic conditions is federal government spending.

This is known as fiscal dominance, where:

- The government runs massive deficits.

- The Federal Reserve is forced to keep rates low to finance the debt.

- Inflation persists because the government spends more than it collects.

This is not sustainable, and eventually, policymakers will have to choose between high inflation or painful spending cuts, neither of which are politically attractive.

Future Predictions: What Lies Ahead?

For Investors:

- Expect More Volatility: The S&P 500 and other assets will remain volatile as markets struggle to price in Fed policy shifts.

- Gold and Crypto as Inflation Hedges: If inflation continues rising, alternative assets like gold and Bitcoin could see increased demand.

- Long-Term Bond Yields Will Stay Elevated: Investors should prepare for higher yields on Treasury bonds, reflecting persistent fiscal risks.

For Businesses and Consumers:

- Higher Loan Costs: Mortgages, auto loans, and credit cards will remain expensive due to tight liquidity conditions.

- Stagflation Risk: A slow economy with persistent inflation could reduce consumer purchasing power.

- Debt Risks: Companies relying on low-interest financing may struggle, increasing default risks in high-debt industries.

For Policymakers:

- Fiscal Reforms Needed: The U.S. must address long-term spending issues or risk losing investor confidence in Treasuries.

- More Political Gridlock Likely: With elections approaching, fiscal policy will remain heavily politicized, limiting meaningful reforms.

- Possible End to the Fed’s Independence? If fiscal dominance worsens, the Fed may be forced to prioritize government financing over economic stability.

Closing Thoughts: The Road Ahead for the U.S. Economy

The Federal Reserve’s pause in rate cuts marks a significant turning point in the inflation battle, yet the real challenge lies in Washington’s uncontrolled spending and borrowing. With fiscal dominance shaping economic conditions, monetary policy alone may not be enough to stabilize inflation.

Fruit for Thought:

- Will the U.S. government be forced into fiscal austerity to prevent a debt crisis?

- Could the Fed return to aggressive tightening if inflation spikes again?

- Are we witnessing the early stages of a financial system reset similar to past economic crises?

As uncertainty looms, investors, businesses, and policymakers must prepare for an era of heightened volatility and financial stress.

Disclaimer:

This article is based on insights from Bloomberg’s coverage of the Federal Reserve’s interest rate decisions and broader economic trends. It is intended for informational purposes only and does not constitute financial or investment advice. Readers should consult financial experts for personalized guidance.

Daniel Cho is a macro-economist focusing on inflation trends and their effects on global supply chains. He is a frequent contributor to economic magazines.