Introduction: Meta’s Corporate Move Under Scrutiny

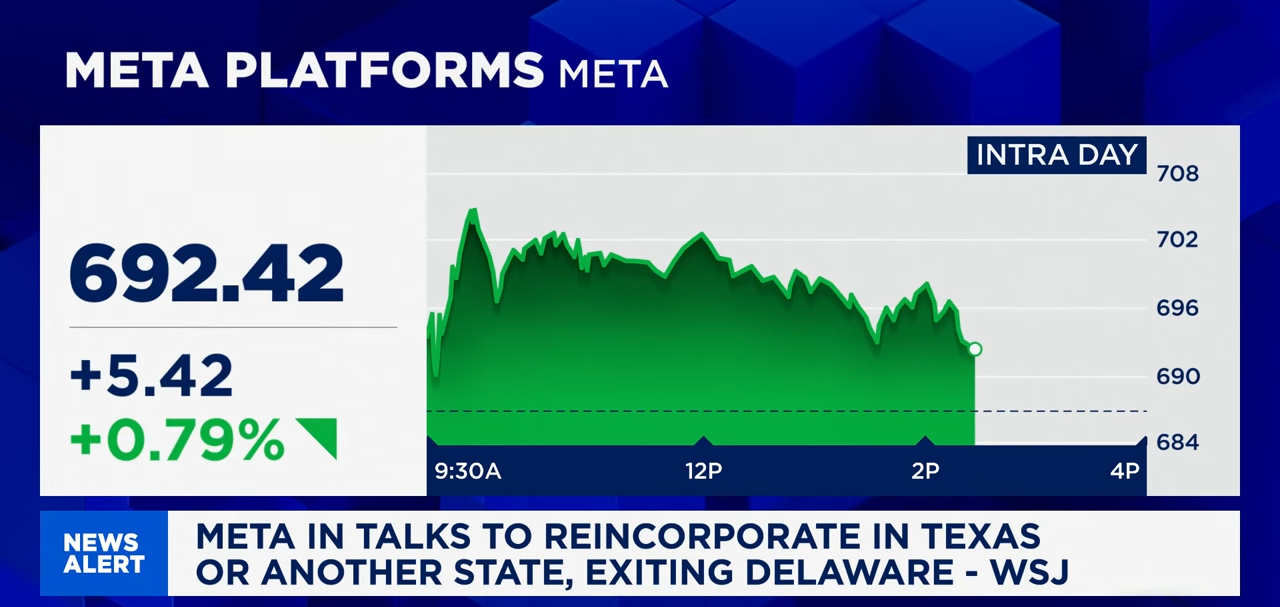

Breaking news from Bloomberg’s New Economy segment suggests that Meta Platforms is considering reincorporating in Texas or another state, possibly exiting Delaware—a move that mirrors recent corporate decisions by high-profile CEOs like Elon Musk.

Meta, however, has denied these claims, stating that its corporate headquarters will remain in California. The distinction between corporate headquarters and incorporation location is crucial—while Meta’s operational base remains in California, changing its state of incorporation could impact taxation, regulatory oversight, and legal frameworks affecting its business operations.

With Delaware serving as the corporate hub for the majority of Fortune 500 companies, any shift by Meta raises questions about the evolving corporate landscape in the U.S. and the potential impact on governance, content moderation policies, and investor sentiment.

Key Discussions and Implications

Why Would Meta Consider Leaving Delaware?

Delaware has long been the preferred state for corporate incorporation due to its business-friendly laws, tax benefits, and legal predictability. However, recent shifts in corporate governance, regulatory pressure, and tax policy changes have led some companies, including Tesla, to reconsider their incorporation state.

Potential Reasons for Meta’s Reincorporation Discussion:

- Regulatory Environment: States like Texas have looser corporate governance regulations, which could allow Meta greater flexibility in handling legal disputes, shareholder rights, and board structures.

- Tax Considerations: While Delaware does not tax corporate income, it does impose fees and franchise taxes. Texas, on the other hand, has a no corporate income tax policy, which could be financially appealing.

- Content Moderation & Free Speech Laws: States like Texas and Florida have recently passed legislation aimed at regulating content moderation policies for social media companies. A move away from Delaware could indicate a shift in Meta’s approach to content governance.

Meta’s Response: No Plans to Relocate HQ, But What About Incorporation?

Meta has denied any plans to move its corporate headquarters out of California, where its workforce and engineering operations remain concentrated. However, the possibility of reincorporation remains a gray area.

Distinction Between Headquarters and Incorporation:

- Headquarters Location: Determines where a company’s main operations, executives, and employees are based.

- Incorporation Location: Determines legal jurisdiction for taxes, regulatory compliance, and corporate governance.

If Meta reincorporates in Texas or another state, it could reshape its legal obligations and financial structure while still maintaining its core workforce in California.

What This Means for Investors, Employees, and the Tech Industry?

For Investors:

- A shift in incorporation could indicate a broader restructuring of Meta’s corporate governance, signaling either cost-cutting strategies or legal maneuvering.

- Regulatory changes in Texas could affect shareholder rights, executive decision-making, and legal protections, potentially altering investor sentiment.

For Employees:

- While headquarters will remain in California, legal residency rules and employment laws could change if the company shifts incorporation to another state.

- Certain legal protections related to workplace regulations, equity compensation, and stock options could be impacted depending on Texas corporate laws.

For the Tech Industry:

- If Meta follows the trend of high-profile companies reincorporating outside of Delaware, it could set a precedent for other Big Tech firms to explore alternative incorporation states.

- Tech companies are increasingly reevaluating content moderation regulations, tax incentives, and governance structures—Meta’s potential move could accelerate this trend.

Future Predictions: What Comes Next for Meta and Corporate Relocation Trends?

For Meta:

- Short-Term: No immediate relocation of headquarters, but legal filings and tax restructuring could surface in coming months.

- Long-Term: If regulatory conditions worsen in Delaware, Meta could quietly proceed with reincorporation efforts, similar to Tesla’s transition to Texas.

For the Broader Corporate Landscape:

- Possible Exodus from Delaware: If Meta reincorporates outside of Delaware, other Fortune 500 companies may reconsider their incorporation strategy.

- Increased Competition Among States: Texas, Florida, and Nevada may compete for corporate relocations by offering tax incentives and regulatory benefits.

- Legislative Response: Delaware may reform its corporate governance laws to retain major corporations and prevent a mass exodus.

What This Means for Investors, Employees, and the Tech Industry

For Investors:

- A shift in incorporation could indicate a broader restructuring of Meta’s corporate governance, signaling either cost-cutting strategies or legal maneuvering.

- Regulatory changes in Texas could affect shareholder rights, executive decision-making, and legal protections, potentially altering investor sentiment.

For Employees:

- While headquarters will remain in California, legal residency rules and employment laws could change if the company shifts incorporation to another state.

- Certain legal protections related to workplace regulations, equity compensation, and stock options could be impacted depending on Texas corporate laws.

For the Tech Industry:

- If Meta follows the trend of high-profile companies reincorporating outside of Delaware, it could set a precedent for other Big Tech firms to explore alternative incorporation states.

- Tech companies are increasingly reevaluating content moderation regulations, tax incentives, and governance structures—Meta’s potential move could accelerate this trend.

Future Predictions: What Comes Next for Meta and Corporate Relocation Trends?

For Meta:

- Short-Term: No immediate relocation of headquarters, but legal filings and tax restructuring could surface in coming months.

- Long-Term: If regulatory conditions worsen in Delaware, Meta could quietly proceed with reincorporation efforts, similar to Tesla’s transition to Texas.

For the Broader Corporate Landscape:

- Possible Exodus from Delaware: If Meta reincorporates outside of Delaware, other Fortune 500 companies may reconsider their incorporation strategy.

- Increased Competition Among States: Texas, Florida, and Nevada may compete for corporate relocations by offering tax incentives and regulatory benefits.

- Legislative Response: Delaware may reform its corporate governance laws to retain major corporations and prevent a mass exodus.

Closing Thoughts: The Bigger Picture of Corporate Reincorporation

The debate over Meta’s possible reincorporation underscores a broader shift in corporate governance, taxation, and regulatory strategies in the U.S. While Delaware remains a dominant player, states like Texas and Florida are positioning themselves as business-friendly alternatives.

Fruit for Thought:

- Will Meta’s potential move trigger a larger corporate exodus from Delaware?

- How might content moderation laws influence the decision-making of social media companies?

- Could investors push back against changes in governance structures and shareholder rights?

As Meta and other tech giants navigate complex legal landscapes, the coming months may reveal whether corporate reincorporation becomes a new norm in the tech sector.

Disclaimer:

This article is based on Bloomberg’s coverage of Meta’s potential reincorporation and broader corporate governance trends. It is intended for informational purposes only and does not constitute legal, financial, or investment advice. Readers are encouraged to consult legal experts for personalized guidance.

Author Bio:

James Patel

James Patel is an experienced business journalist reporting on mergers, acquisitions, and corporate governance. He has contributed to The Wall Street Journal and Reuters.

James Patel is an experienced business journalist reporting on mergers, acquisitions, and corporate governance. He has contributed to The Wall Street Journal and Reuters.